Student representatives endorse student loan wage garnishment cap

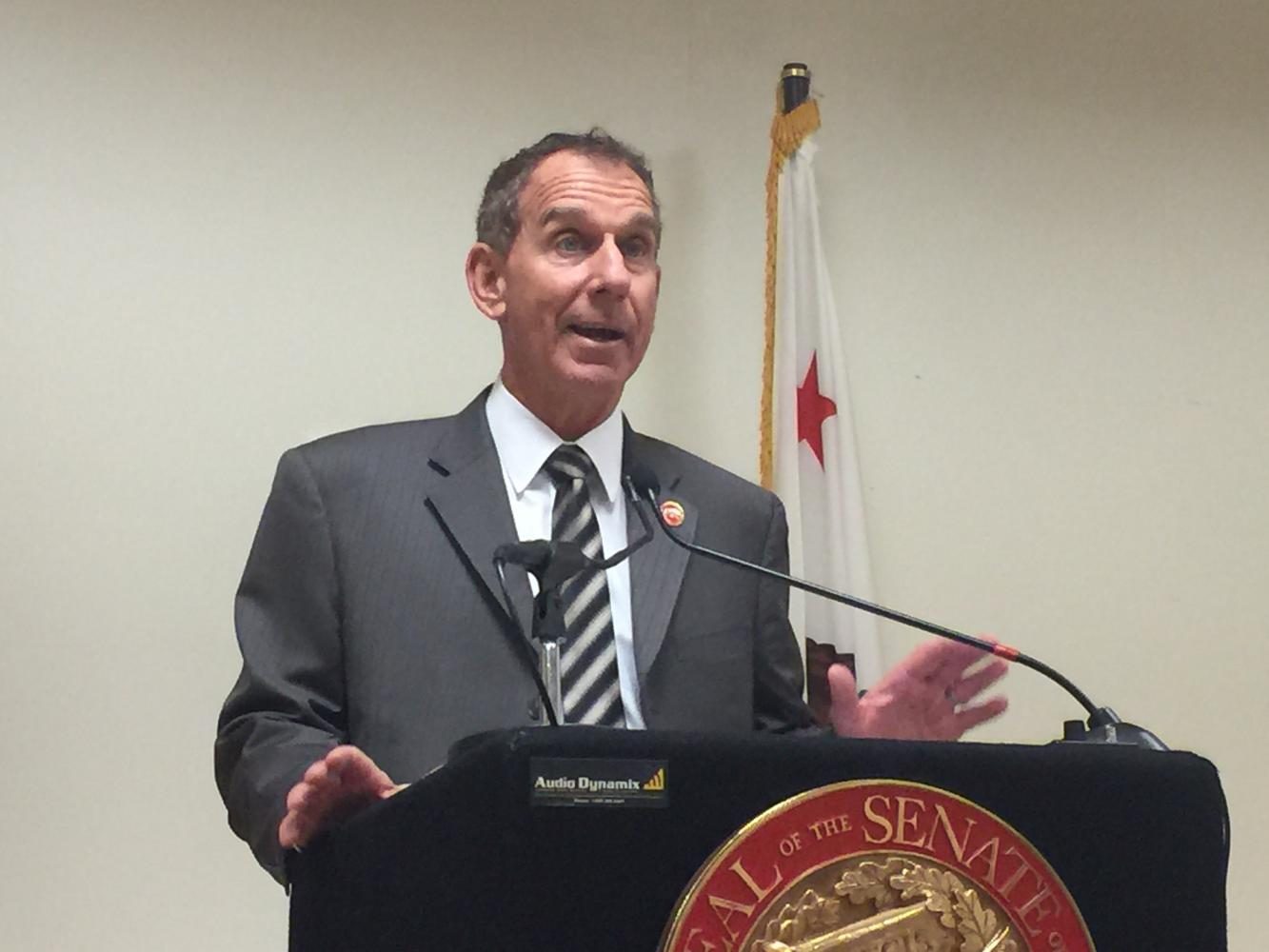

California State Senator Bob Wieckowski speaks at a press conference regarding Senate Bill 16 at Sacramento State on Wednesday, Aug. 30. SB16, which was authored by Wieckowski, would lower the cap on the amount of wages private student loan lenders can garnish from borrowers.

California State Senator Bob Wieckowski, joined by student representatives from Associated Students, Inc and the California State Student Association, held a press conference at Sacramento State Wednesday to rally support for a bill which would lower the cap on the amount of wages private student loan lenders can garnish from borrowers.

Under Senate Bill 16, the amount private banks would be able to garnish would be capped at 15 percent of a borrower’s wages, which is consistent with the federal student loan cap, rather than the current 25 percent.

Associated Students, Inc. has endorsed the bill, along with the California State Student Association, the California Faculty Association and the California Association of Nonprofits, among others.

Sen. Wieckowski, D-Fremont, who authored SB 16, spoke of the importance of the bill as a piece of a solution to overwhelming student debt rates in California.

“This is just a small slice,” Wieckowski said. “Obviously, on the front end, one (part of the solution) is to reduce tuition costs, the other is to do financial education to students and their parents before they sign (private student loans).”

Wieckowski stressed that allowing the current cap to stay in place would serve as an impediment toward the success of recent graduates.

“It’s time to create some parity between the federal and private student loans when it comes to garnishing the little bitty check that struggling workers have,” Wieckowski said.

Sacramento State student Ryan Brown, a special officer with the California State Student Association, used an anecdote about a friend’s experiences with student loan garnishments to highlight the bill’s potential impact on recent graduates.

Ryan Brown of @csustudents speaks in favor of #SB16 at Sacramento State pic.twitter.com/aEsaiyrzbN

— Barbara Harvey (@barbaraaharvey) August 30, 2017

“I happen to know a student personally who graduated years ago, who is, unsurprisingly, working as a barista. He graduated with a BA in government,” Brown said. “He is still living with his parents. He is trying to find a better job. He’s trying to save money to go to grad school. But he can’t, because his wages are being garnished. He’s not able to save the money he needs to go on with his life.

“Senate Bill 16 is going to directly impact this person’s life and allow them to succeed,” Brown said.

https://twitter.com/barbaraaharvey/status/902933090200203265

Sacramento State student and ASI legislative affairs coordinator Travis Legault, who provided an endorsement on behalf of ASI, said that his concerns about what the economy will look like when he graduates contribute to his support of the bill.

“I cannot imagine trying to dig myself out of the hole that I would be in at a 25 percent wage garnishment, especially in this state, where we see the cost of housing, the cost of living is going up every year,” Legault said.

“I hope that Assemblymembers that may be on the fence about this piece of legislation will think about the students that will be affected, now and in the future.”

Wieckowski concluded the event with a plea for help.

“I need your help. I didn’t get enough votes in the Assembly last time we brought this up, so we’re bringing it up again,” Wieckowski said. “Let’s pass this thing. Let’s get it done, and let’s remove this burden and this impediment to so many students.”

Your donation will support the student journalists of Sacramento State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Amorette Bryant • Sep 1, 2017 at 1:01 pm

Employers support a reduction for private student loans to meet the federal withholding limits of 15% of disposable earnings, with protection of 30 times FMW.

Many employers and software vendors cannot correctly withhold for creditor garnishment using current requirements for creditor garnishment because the use of lesser of State or Local minimum wage (22 cities counties with greater LMW). It has become an administrative and technical nightmare. SB 16 mirrors the state wage garnishment legislation except the withholding percentage, is reduce to 15% rather than 25%.

So if business cannot even correctly withhold for a creditor garnishment correctly, how will they withhold for the private student loans correctly?

Amorette Nelson Bryant

Author, Complete Guide to Federal and State Garnishment