OPINION: Congress fails students with tax reform

December 6, 2017

Congratulations to the U.S. Congress on its impending fundamental change to federal tax laws! It is warmly reassuring to know that finally, deep into my college career, that someone in Washington D.C. is looking after who matters most: corporations.

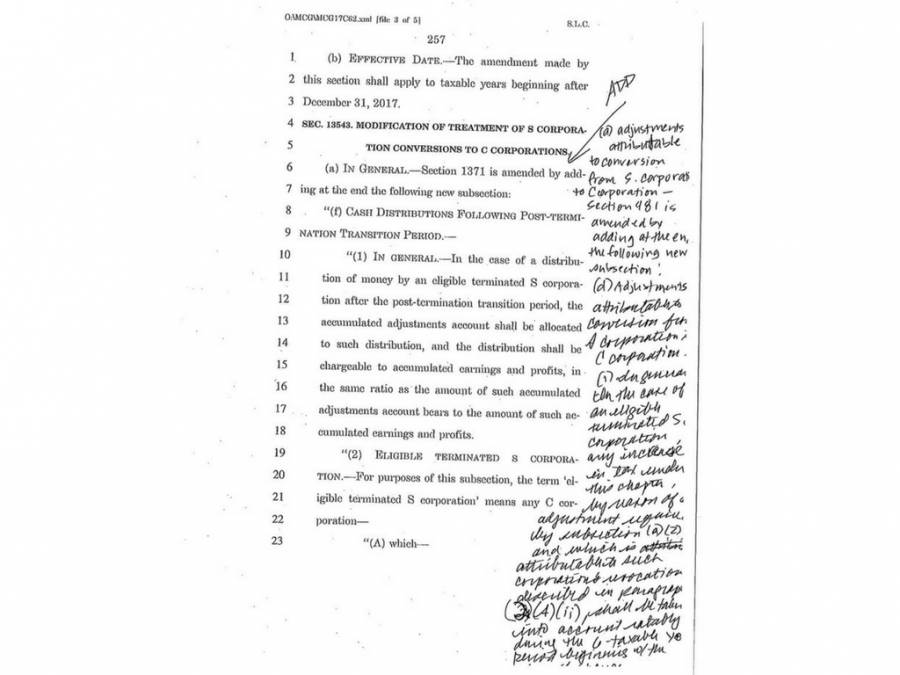

I’m kidding, obviously. The new tax bill (which is still not official, but likely will be very soon), could be detrimental to Sacramento State students for a whole bunch of reasons. While some of these reasons are still unknown because parts of the bill are illegible, and amendments were made while the votes to pass it were still being cast, we do know that it has the potential to tax endowments received by universities.

These endowments can act as sources for scholarships that are distributed to both lower-income and minority students. Taxing the endowments would make it more difficult for our school, and many others, to provide the monetary support to those who depend on financial aid to make it through school.

Not only will a large demographic of potential students miss out on the opportunity to attend the university of their choice, but the community itself will miss out on some of the racial and class-based diversity that makes it so special.

We deserve so much more than this, especially considering that it is such a blatant rush job. If a Sac State student turned in a paper with pen-written revisions, they’d get an F.

Our school is already spending more money than the state or country is offering it, funneling hundreds of thousands of dollars into an athletic program that isn’t performing up to par and remodeling nearly half of campus while taking in more and more students each semester.

Now, to add to this mess, the federal government has stepped in and not only made conditions worse for students who are enrolled, but have set up yet another barrier for underrepresented students to attend school in the first place. So much for getting an education in order to climb the social and economic ladders.

The Trump administration has also already made changes to how colleges handle sexual assault, discussed changes to affirmative action in enrollment and seems set on dismantling many of the country’s services that help poor Americans most.

The bill would remove the mandate for health insurance, which could, in turn, leave an estimated 13 million Americans without health care and premium increases somewhere around 10 percent.

The bill also increases taxes for high-tax states. Naturally, California is one of the states included. This is a blatant attack on states that typically vote Democrat and is one of many special interests stuffed into the bill that will have a long-term effect on the country.

The good news is that these Republicans — the ones who barely got the bill through Congress at all — have to run again in 2018. They can be replaced, as can the laws they are stuffing through the legislature like there’s no tomorrow.

Connie • Dec 6, 2017 at 8:57 pm

It’s as if our government doesn’t want its citizens to be educated. Lender’s already charge high interest rates on student loans and now Congress is taking away the ability to deduct that interest on tax returns. Your generation has the ideas and energy to go out and make this world a better place. You can make a difference in politics by studying the issues, voting, contacting your Congressmen and even protesting. Don’t underestimate what you are capable of and remember to be kind and tolerant on your journey through this life.