Biden announces student loan relief plan, cancels up to $20,000

Students hope for help paying for college

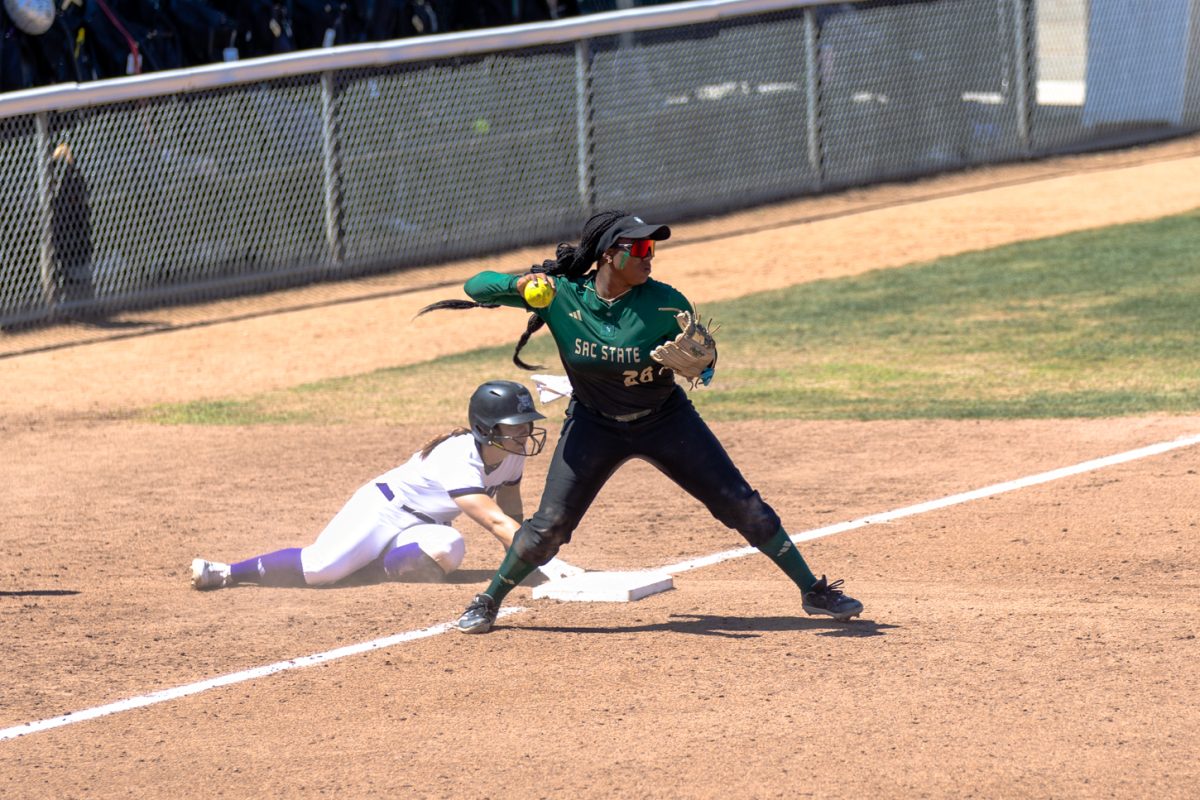

President Joe Biden announced a student loan relief plan last week hoping to help borrowers across the nation by cutting down their student debt. Students at Sac State are uncertain if they will be recipients of this new plan. (Photo by Shane T. McCoy / CC BY 2.0 / Graphic created on Canva by Kamelia Varasteh).

September 3, 2022

It is no lie that college can become challenging to pay for, especially for low-income students. However, help could be on the way for students with student loans as President Joe Biden announced up to $20,000 of student loan relief for students in low-to-middle class households.

According to last week’s White House release, individual borrowers with loans held by the Department of Education and whose annual income is below $125,000 are eligible for the relief. If married, borrowers qualify if their joint income is less than $250,000 per year.

The release also stated that Pell grant recipients will be eligible for the relief; however, borrowers who did not receive a Pell grant and do not meet the income requirements will only be eligible to receive up to $10,000.

Approximately 43 million borrowers are eligible for this relief and Biden hopes it will help borrowers of all ages. According to Federal Student Aid, up to eight million loan recipients will be receiving automatic payments, through information already in the system of the Department of Education.

Ashley Villeino is a first-year nursing student who said she is unsure if she will receive the relief. However, she did say that she had to take out her loans in response to the pandemic.

“I just took them out because my family could not pay out of pocket,” Villeino said. “We are kind of money-tight right now because of everything that happened with Covid. Right now, my family can’t pay out of pocket and neither can I.”

Students often try to avoid having to take out student loans; however, sometimes circumstances force students to have to take them out.

Ilona Ukstina, a fifth-year biomedical sciences major, said she had to take out loans after returning from studying abroad. Upon her return, she did not have a job to pay for her education.

“I’m furthering my education as well, so it will be less debt when I finish that school as well,” Ukstina said. “It’s just nicer to have that on your shoulders when you’re going to school.”

Third-year history major Joseph “Joey” Ruwrat said they were also forced to take out a loan, despite attempting to avoid it.

Ruwrat added that they were working full time while attending school to avoid taking out a loan. However, they say they are glad to have taken out a loan because now they have a safety net of money to fall back on.

The relief plan consists of three parts and with potential to provide more “breathing room to America’s working class families,” according to the release. The White House fact sheet release stated that the three parts would provide financial aid relief as a result of the pandemic, help make the student loan system more workable for current and future students, and to aid in holding schools accountable for increasing tuition costs. Financial Aid and Scholarships office Director Anita Kermes said that something to keep in mind is that this aid applies to loans fully disbursed prior to June 30 this year. As for now, private loans do not qualify for the relief but federally owned loans do.

More information can be found through the White House release and through the Federal Student Aid websites.