Recent grads face grim job market

Labor statistics :Source: Bureau of Labor Statistics:Alicia Palenyy – State Hornet

November 9, 2010

A recent analysis by the Economic Policy Institute estimates college graduates would earn 30 to 35 percent less in wages by choosing to work outside their field.

The analysis was based on data gathered by the Bureau of Labor Statistics. The data shows unemployment rate for college graduates under 25 years old averaged 9 percent in March compared with 5.4 percent in 2007.

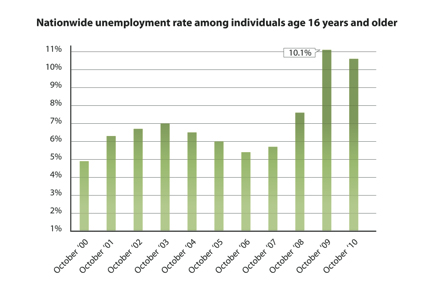

As of last month, the unemployment rate was 9.6 percent.

However, according to the analysis, this rise in unemployment does not show whether graduates are working in jobs that match their skill level &- meaning the labor problem is understated.

“They could be employed full time, but at a job for which skills and training obtained in college are not put to use,” the analysis stated. “These bad labor market matches may not only make it more difficult for less-credentialed workers to compete for those jobs, they may also reduce the earning potential for graduates.”

A study by Yale economics professor Lisa Khan shows a correlation between unemployment rate and the wages of recent college graduates entering the workforce.

Because there are fewer jobs to choose from in a weak economy, some graduates apply for work that leaves them underworked or underpaid, according to Khan’s study.

“The immediate disadvantage of graduating from college in a poor economy is apparent,” Khan wrote. “What is less clear is how these college graduates will fare in the long run relative to their luckier counterparts.”

Khan used the National Longitudinal Survey, which gathers labor information from select groups of people across the country, to compare Caucasian graduates’ wages during and after the 1980s recession. The elements she connected to unemployment were salary, labor supply, occupation and level of education. The survey allowed her to follow each participant for at least 17 years after college graduation.

Khan found out for each percentage-point increase in the unemployment rate, those who graduated during the recession earned 7 to 8 percent less in their first year out of college than comparable workers who graduated in stronger economic times.

“This effect lingers over many years,” Khan wrote, “with recession-era graduates earning 4 to 5 percent less by their 12th year out of college, and 2 percent less by their 18th year out.”

Beth Merritt Miller, director of the Career Center at Sacramento State, said graduates from California need to be especially diligent in their job search because the state’s economy is recovering slowly.

“In this economy, it’s important to have a polished resume and interviewing skills,” Merritt Miller said. “Getting professional experience in a difficult economy is more important than waiting for that ideal job. It may take a bit longer to get to that “dream’ job but having work experience will move graduates to that opportunity quicker.”

Sac State alumna Ara Antonio, who graduated in May, said she started looking for a job two to three months after she came back from a vacation.

“What I’ve noticed during my interviews is that even though there are plenty of openings out there, there are twice as many applicants for the position,” Antonio said. “It’s a big competition out there for everyone searching for a job.”

She said despite being fully supported by her parents, she wants to earn her own income and support herself, even if it means getting a job outside the field in which she graduated.

“I’ve been searching for jobs, and there are plenty available out there,” Antonio said. “The only problem is that they have more requirements now than they used to have. They’re looking for more experience; entry-level jobs don’t seem to be for new grads anymore.”

She said because of the tough economy and high unemployment rate, companies are hiring overqualified applicants who are willing to accept lower pay, leaving new graduates like her jobless. Even if she gets a job related to her degree in finance, she will not be content with her salary.

“No matter where I look, all companies and businesses are giving salaries that are less than what an educated person should be earning,” Antonio said. “The economy’s just plain hard on everyone right now. Almost anybody would be willing to be employed and paid for less, than be unemployed and earn nothing.”

Micah Stevenson can be reached at [email protected].