Wait, pickup for checks to end

Wait, pickup for checks to end

April 2, 2008

Sacramento State students on financial aid potentially will no longer have to wait for checks to be mailed or prepared for pick-up.

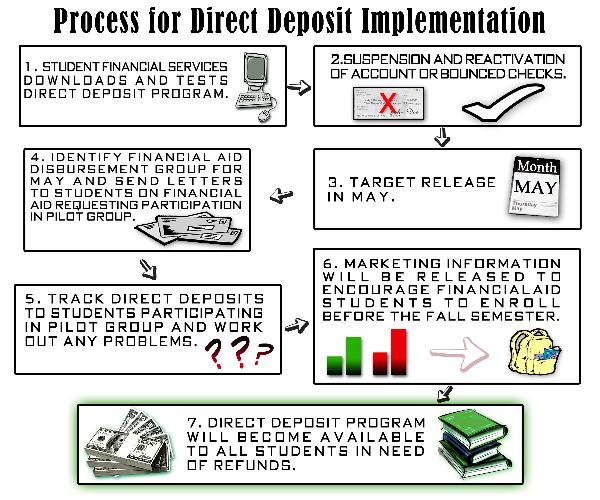

The university is setting up a new module that will allow students to receive financial aid checks through a direct deposit into their bank accounts.

Gina Curry, director of the Student Financial Services Center, said the direct deposit program is targeted for release in May to a pilot group of volunteer financial aid students.

“It’s great for student service in addition to just being a good business process. We are in an electronic age, so anything electronic is great,” Curry said.

Approximately 12,000 to 14,000 students on financial aid receive at least one check during a semester and 300 request the check be held for pick-up, Curry said.

Checks are issued to students on financial aid when there is a credit balance on the students’ accounts. A credit balance results when there is money from financial aid left over after all university fees, such as registration and housing, have been paid.

Curry said the program will allow students on financial aid to receive the money in their bank accounts potentially in less than one day instead of waiting days to receive the check before it can be deposited.

Craig Yamamoto, director of the Financial Aid Office, said lost or misplaced checks would be eliminated for students enrolled in the program.

“I know that there are some students who lose their checks and have to go through a whole process to get the check reissued,” Yamamoto said.

Curry said the Student Financial Services Center’s accounting office replaced 550 to 650 checks in the last two years because the checks were lost, damaged or not cashed within six months.

Yamamoto said the program would benefit students on financial aid because it is quicker.

“We’re here to support the students and we know that they need their financial aid money, so they can pay their books, pay their parking permit, get their books and supplies, pay for their dorms or apartments,” Yamamoto said.

Suzanne Green, university CFO designee for Associated Students Inc. and associate vice president of Financial Services, announced the release of the module at the ASI board meeting on March 12.

During the announcement, ASI President Christina Romero smiled in support of the module. Romero could not be reached for comment.

Darlene Gillum, director of Finance and Administration for ASI, said ASI would support the module because it uses direct deposits for employees and payments.

Gillum said the most beneficial aspect of the module is getting the funds in the hands of students quicker.

The program will be free for students and is funded through the all-university expense budget, Curry said. The budget pays for global programs and services that run the university.

In order to participate in the program, students will have to enroll themselves through the MySacState website and entering their bank accounts and routing numbers.

Curry said this procedure secures the account information because there is not a written form that has to be submitted.

“It also creates potentially less entering errors when there are multiple people entering the check account. You’d have to write it down correctly and we’d have to enter it correctly. So anytime you involve the human piece of it, there’s a chance for errors,” Curry said.

Gillum agreed the self-enrollment allows students to keep their bank accounts or routing numbers private.

“It’s not written on a piece of paper. They’re doing it all online, so it’s not being passed from hand to hand,” Gillum said.

Curry said if a student enters in the account number incorrectly, the Student Financial Services Center will know in one day of attempting to deposit a check into the student’s account.

A paper check will be produced and a notification will be sent to the student to confirm the account number entered online, she said.

The student’s bank must be enrolled in the automated clearing house program that allows the bank to process direct deposits.

Students whose banks do not have automated clearing house will have to continue picking up or receiving the checks through mail.

Gillum said this requirement will affect students who belong to small banks that don’t have the direct deposit capabilities or students without bank accounts.

“It may be a good idea to ask your bank before you enroll if they are part of the automated clearing house network,” Curry said.

Curry encourages all students who enroll in this program to keep their MySacState password private to prevent access to their bank accounts.

The university released a password change initiative through MySacState on Thursday to encourage students, faculty and staff to do a pass-phrase change in place of their one-word password.

“It can be a fairly lengthy phrase like ‘I’m a Sac State Hornet fan.’ It’s very long and very hard for someone to hack or guess,” Curry said.

Curry said the use of direct deposits would also cut down on the money spent to produce paper checks.

She said if 40 to 50 percent of students on financial aid enroll in the program, the university is estimated to save $20,000 in hard costs during the first year. Curry said hard costs include postage and hard stock.

Checks go through three offices before they are distributed to students, using up time and energy of staff, Curry said.

“When we’re all facing budget cuts in our departments and staffing and trying to do more with fewer staff, that’s going to be a really good lessening of impact for our offices,” Curry said.

Students who are not on financial aid will have access to the service when they receive any overpayment checks from the university.

Some students will never overpay their accounts and will not have a need to use the program.

Ashley Downton can be reached at [email protected].