Students for Justice in Palestine (SJP) has been advocating for Associated Students, Inc. to pass a resolution asking the California State University system to divest from corporations involved in what the club says are unethical practices.

SJP’s proposed resolution targets corporations that have financial relationships with the CSU or University Enterprises, Inc. (UEI) — the corporation that is responsible for the Sacramento State bookstore and dining.

These include Wells Fargo (an investor in privately owned prisons), Sabra Dipping Co. (which has factories on Israeli settlements in the Palestinian territories) and JPMorgan Chase & Co. (an investor in the Dakota access pipeline).

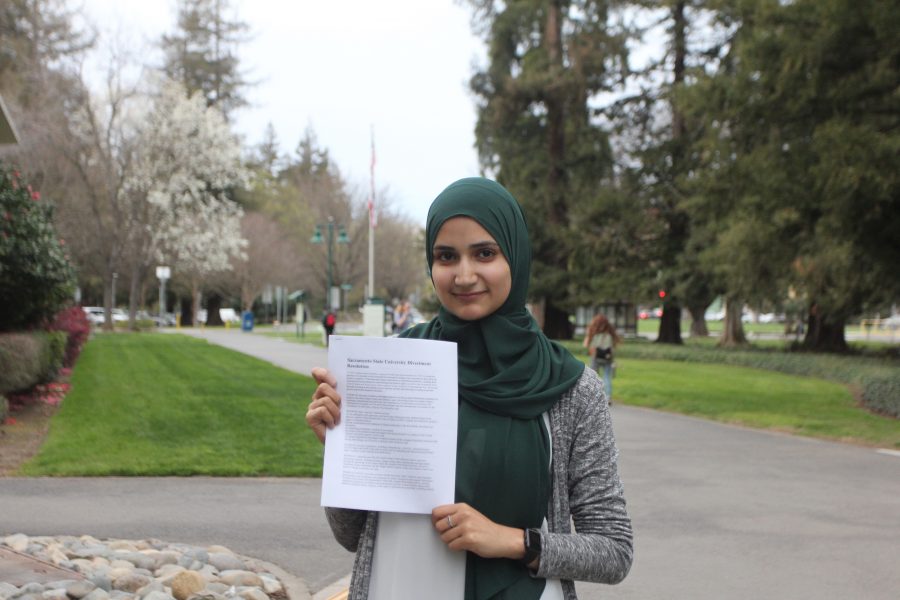

Aya Khalifeh, the president of SJP, said that the bill has been an idea since the club was founded one year ago.

“That was the first thing on our agenda. The club grew to be something bigger,” Khalifeh said. “This is a bill that combines an interest from all the marginalized communities here on campus.”

Other corporations mentioned in the bill are Hewlett-Packard Co. and Caterpillar Inc., whose products and services are used by the Israeli government in the Palestinian territories.

The CSU chancellor’s office endowment fund is invested in Wells Fargo, JPMorgan Chase & Co., Hewlett-Packard Co. and Caterpillar Inc. through index funds and “various large cap, independently managed portfolios,” according to Elizabeth Chapin of CSU Public Affairs.

The four companies are in the Standard and Poors 500, a list of 500 top companies traded on the New York Stock Exchange and the NASDAQ.

“Investment in the S&P 500 is the most common investment strategy of nearly all investors,” Chapin said. “When investing in index funds, investors do not have the option of divesting from particular companies.”

Chapin said that because the money is in index funds, she does not know how much is invested in each.

The University Foundation at Sac State doesn’t have investments in any of the companies mentioned in the proposal, according to Ahmed Ortiz of public relations.

That said, UEI has $11,115 invested in Wells Fargo through the Student Investment Fund. Wells Fargo also rents space in the bookstore for $2,060 per month, according to Ortiz.

Furthermore, JPMorgan Chase & Co. has an ATM at the University Union and Sabra Dipping Co. products are sold at EcoGrounds there.

The SJP proposal doesn’t ask for current contracts to be broken, only that they not be renewed when they expire.

Khalifeh said that she first mentioned the idea to future ASI President Patrick Dorsey in spring 2016 and that in the fall, SJP attended an ASI board meeting to present the proposal.

“A couple of CSUs have already passed divestment resolutions specific only to Palestine and Israel and succeeded in getting their universities to stop associating with human rights violations-complicit companies,” Khalifeh said. “As an institution that does invest and does business with these companies, we are complicit in the human rights violations these companies commit. It’s very simple.”

Abraham Mendoza, the ASI vice president of academic affairs, agreed to sponsor the proposal as a bill.

“They told us we’d need a student survey to find out how the student body would react,” Khalifeh said. “It usually goes through student organizations first; they have a public forum where students can say what they feel about it, and then they vote.”

Mendoza agreed that a forum seeking student input and featuring both sides of the issue would be beneficial and withdrew the bill.

“The plan was that once the survey had been conducted, and the forum had been held, I would reintroduce legislation to vote on the issue before the end of the semester,” Mendoza said.

Since that time, a forum has not been held. SJP was tasked with finding a room for the open forum, but Khalifeh said that she feels that this should be ASI’s responsibility because the board requested it.

“I more felt like ASI telling us we need a public forum, which we understand and accept as part of the process, gives them the responsibility to set up this public forum,” Khalifeh said. “I keep asking Abraham about it and he said it’s not something he can get done on his own. … I don’t think he has confidence that the bill would pass. He doesn’t think it’d be a good time right now.”

Mendoza said that the holdup can be partially attributed to the fact that the ASI member who had been working on the project of compiling the student survey left the board at the end of the fall semester.

“New board members who were not there for the initial discussions and presentation need to be brought up to speed,” Mendoza said. “I personally do not feel like ASI is attempting to sideline the process.”

ASI President Patrick Dorsey declined a request for comment.